oregon tax payment extension

Use blue or black ink. Dont submit photocopies or use staples.

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Only taxpayers with more than 1 million of taxable Oregon commercial activity will have a payment obligation.

. These back taxes forms can not longer be e-Filed. This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it. If you file more than three months after the due date including extensions a 20 percent late-filing penalty will be added.

Just make sure its done by the deadline to avoid penalties and fees. All Oregon residents and businesses are required to file annual City of Oregon income tax returns as well as any businesses with net profit or loss earned within the city. The 2021 tax deadline to file City of Oregon returns is April 18 2022.

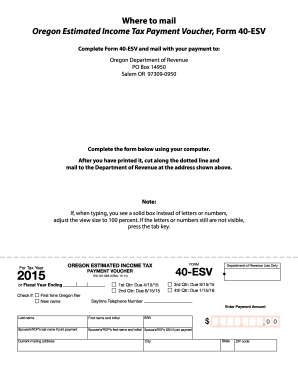

Print actual size 100. Clear form Form OR-40-V Oregon Department of Revenue Oregon Individual Income Tax Payment Voucher Page 1 of 1 Use UPPERCASE letters. Dont worry we can help.

Prepare only a OR State Return without an IRS return. Portland Business License Tax and related surcharges and fees Multnomah County Business Income Tax and Metro Supportive Housing Services SHS Business Income Tax are paid through the City of Portland. Make a quarterly payment online Quarterly Coupon Forms Instructions.

But not to worry you can check the status of your refund. Oregon State Income Tax Forms for Tax Year 2021 Jan. Use blue or black ink.

Instructions Resources on how to prepare and e-File Oregon Tax Returns or how to prepare an Extension andor previous Year Tax Returns. Quarterly payment requirements information. The tax is computed as 250 plus 057 percent of Oregon commercial activity in excess of the 1 million threshold ORS 317A125.

This includes payment of your 2021 tax liability. So you will owe a total. Details on how to only prepare and print a Oregon 2021 Tax Return.

The hardest part of getting a tax refund payment is waiting for it to arrive. The CAT is applied to Oregon taxable commercial activity in excess of 1 million. If you do not have a tax balance due but would like to file an extension your federal or state extension will serve as your Metro SHS andor your Multnomah County PFA Personal Income Tax extension.

Q-2020 Form 2020 Instructions. Make quarterly or extension payments pay a. Hit that refresh button as many times as you want.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Oregon doesnt allow an extension of time to pay even if the IRS allows an extension. Below are forms for prior Tax Years starting with 2020.

Start Federal and Oregon Tax Returns. Check the Extension Filed box when you file your personal income tax returns and attach a copy of your federal extension or verification of your Oregon extension payment with. Tax year begins MMDDYYYY Tax year ends MMDDYYYY First name Initial Last name Social Security number SSN Spouses first.

You will owe a 5 percent late-payment penalty on any Oregon tax not paid by the original due date of the return even if you have filed an extension. Annual Exemption Request. Print actual size 100.

We last updated Oregon Form 40 in January 2022 from the Oregon Department of Revenue. Dont submit photocopies or use staples. Payment coupons for taxpayers who expect to incur liability greater than 1000 for either jurisdiction in the current tax year.

You can pay in several ways. Prepare eFile a 2021 OR IRS Tax Return. Oregon Tax Deadlines Forms Extension Penalties.

Payment Voucher for Income Tax Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172 Clear form Form OR-40-V Oregon Department of Revenue Oregon Individual Income Tax Payment Voucher Page 1 of 1 Use UPPERCASE letters. Oregon Income Tax Forms.

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Classroom Guide To Fire Safety By The Oregon State Fire Marshal Fire Safety Classroom Classroom Projects

Oregon Estimated Tax Payment Fill Out And Sign Printable Pdf Template Signnow

State Of Oregon Oregon Department Of Revenue Payments

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com