child care tax credit schedule

People who are eligible for a partial amount of Child Tax Credit. Enhanced child tax credit.

New Child Tax Credit Takes Effect In Pennsylvania 90 5 Wesa

The Employer-Provided Child Care Facilities and Services credit allows businesses to receive a valuable tax credit of 25 of related child care expenses and 10 of their resource and referral.

. Claiming the Credit Q1-Q17 Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and. How much money you could be getting from child tax credit and stimulus payments. 30 of the total amount spent by an organization to help employees locate child care.

Married couples filing a joint return with. In general for 2021 you can exclude up to 10500 for dependent care benefits received from your employer. Parents with children aged 5 and younger can qualify for a 300 monthly child and dependent care credit while older children aged 6-17 years old will be given a 250 monthly.

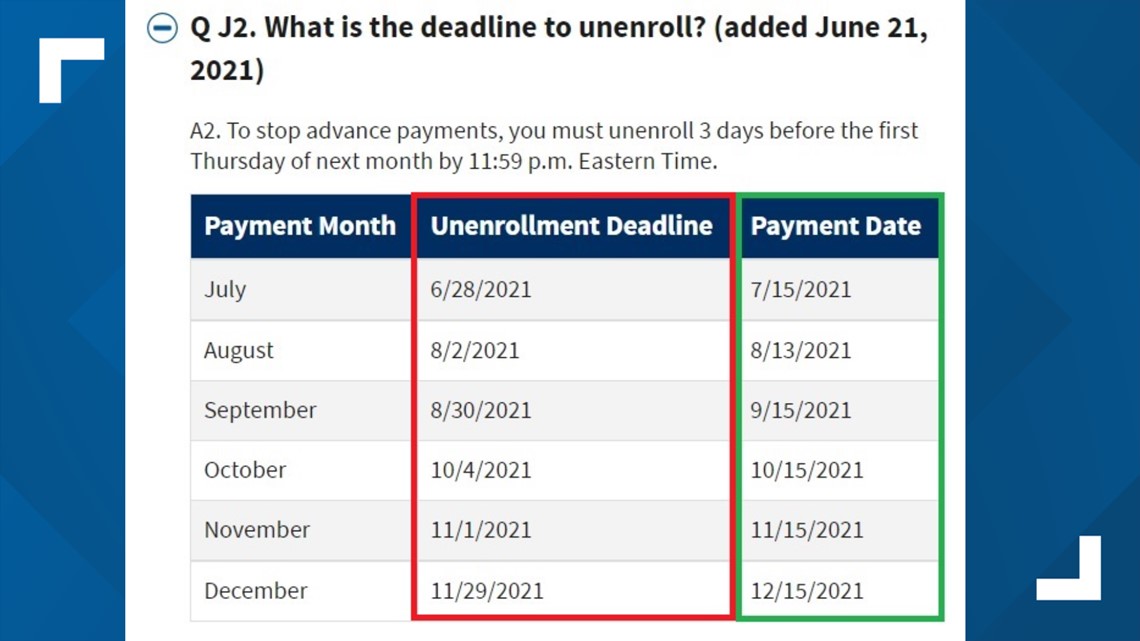

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. 13 opt out by Aug. For children under 6 the amount jumped to 3600.

Information from WhiteHousegov Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides. Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. Formerly known as the Early Learning Tax Credit the District of Columbia Keep Child Care Affordable Tax Credit Schedule ELC is a refundable income tax credit that was enacted in the.

Canada child benefit CCB Includes related provincial and territorial programs. To claim the child and dependent care credit you must also complete and attach Form 2441 Child and Dependent Care Expenses. Up to 8000 for two or more qualifying people who.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6. The Instructions for Form 2441 explain the qualifications.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Additionally in general the expenses claimed may not exceed. For example contributions to a child care resource and referral agency such as Child.

Up to 3600 per child or up to 1800 per child if you received. You will need the following information if you plan to claim the credit. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child.

From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit. To reconcile advance payments on.

Canceled checks or money orders. Cash receipts received at the time of payment that can be verified by. 15 opt out by Aug.

To claim the Ontario Child Care Tax Credit file your tax return and submit a completed Schedule ON479-A Ontario Childcare Access and Relief from Expenses CARE Tax Credit. Advance child tax credit payments.

Save On Child Care Costs For 2021 Dependent Care Fsa Vs Dependent Care Tax Credit

Claiming Advance Child Tax Care Credits For Tax Year 2021 Haugen Law Group

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

:max_bytes(150000):strip_icc()/IRSForm24412-76e295ec60f541aa91f6fe9494b03057.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Q A With Lattaharris Llp Child Tax Care Credit City Of Washington Iowa

Child Care Provisions Were Cut From The Inflation Reduction Act It S Not The First Time Cnn Politics

2021 Child Tax Credit Earned Income Tax Credit Child Dependent Care Deductions Alabama Cooperative Extension System

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Child Tax Credit What Families Need To Know

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Some D C Lawmakers Are Asking If Every Family Should Get A Child Care Tax Credit Wamu

Child Care Contribution Tax Credit The Family Center La Familia

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes

The Deadline To Unenroll Or Opt Out Of The Child Tax Credit Wfmynews2 Com

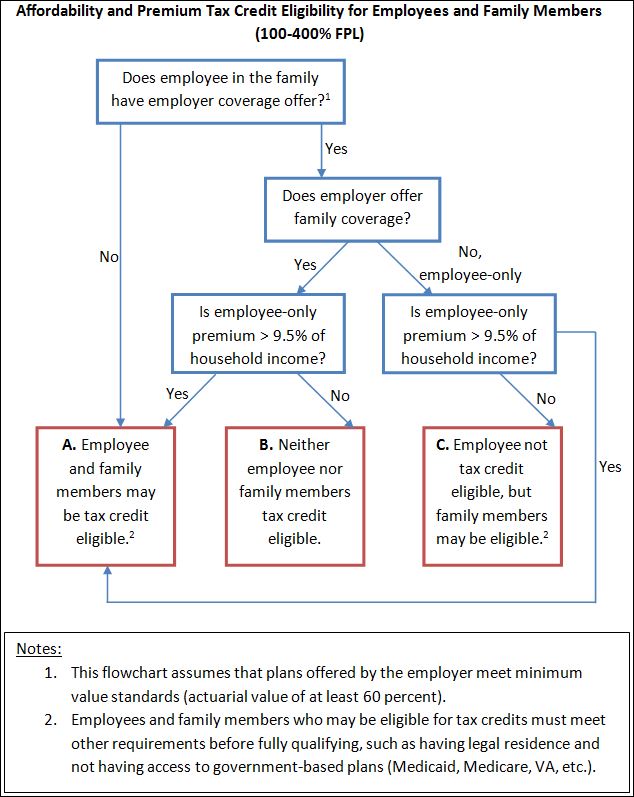

The Most Confusing Source Of Premium Tax Credit Eligibility Made Simple In One Chart The Incidental Economist

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

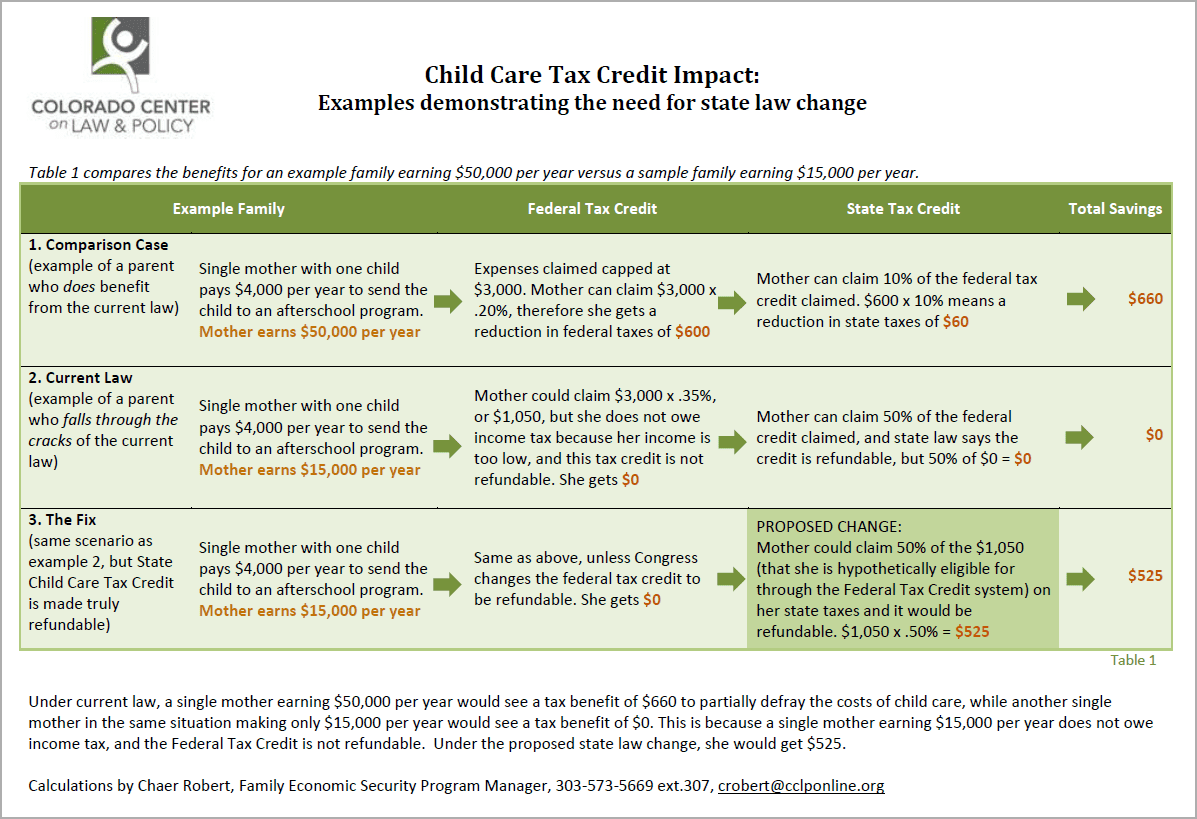

Fixing The Child Care Tax Credit Eoprtf Cclp

Child Dependent Care Tax Credit Atlanta Support Lawyer Smyrna Georgia Divorce Attorney Meriwether Tharp Llc